Virtual credit and debit cards have become extremely popular these days. As the name suggests, these cards don’t have a physical existence. They can be accessed only on the web.

A virtual debit/credit card helps you make online purchases without using your original card number. These cards are provided to keep you protected from online scams and frauds.

These digital cards are assigned a 16-digit unique number, expiry date, and CVV number like any other physical credit/debit card. The best thing about these cards is that they can be used almost anywhere.

Also read: 11 Best Online Investment Platforms & Apps

We have prepared a list of the best virtual credit/debit card services in the USA. If you are interested in applying for a digital card, you should look at the list below.

List of Best Virtual Credit Cards & Debit Cards in the USA

1. PSTNET

PSTNET offers virtual payment cards, Visa/Mastercard in USD and EUR, for global payment of goods and advertising accounts. These cards can be used for transactions on popular services like Steam, Spotify, Netflix, Patreon, and Unity 3D and on trading platforms such as Google Play, Apple App Store, Microsoft Store, PlayStation Store, Epic Games Store, and many others.

Advantages:

- Easy registration (option to use Google/Telegram/Apple ID/WhatsApp or register via email and set a password). The first card is available without the need for document submission and undergoes a simple verification process.

- Multiple types of cards tailored to different needs, including cards with 3D-secure technology (transaction confirmation through SMS codes sent to your account and Telegram bot).

- Convenient funding methods (cryptocurrency, Visa/Mastercard, bank transfers) and the ability to withdraw funds in USDT.

- Additional collaboration features, such as team member management, role assignment, limit setting, a replenishment request system, report generation, and more.

- Advanced two-factor authentication system and a Telegram bot for prompt service notifications.

PST now introduces a special PST Private program for media buying and affiliate marketing teams. As part of the program, users will receive:

- Cashback of 3%

- Up to 100 free cards each month

- The lowest top-up fee

The service is highly popular, as evidenced by the reviews about PSTNET.

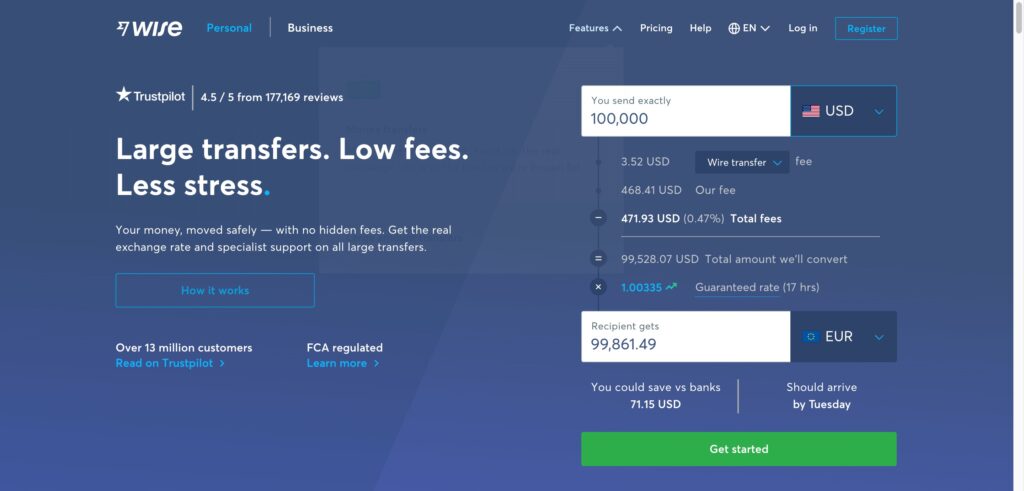

2. Wise

Wise offers you the fastest and cheapest way of sending money abroad. With over 12 million customers, it is one of the trusted services. It is available across 30 countries and has support for over 50 different currencies. It takes just a few minutes to register and get your account verified.

It is a unique application that lets you freeze your online card after making a payment. With the help of this virtual card, you can make online purchases, receive and transfer payments, and even convert currencies. The good thing is it is available for both personal and business use.

3. Payoneer

Payoneer is the best choice for making online payments. You can securely shop at any eCommerce site that supports MasterCard payments using the Payoneer card. Getting a Payoneer card is very easy, especially if you have an account with them. All you have to do is fill out an application, and after the reviewing process, you will be given your virtual credit/debit card.

This virtual card is very similar to a physical debit/credit card. You just have to enter your card details and make payments. It allows you to send and receive payment globally. This makes it an ideal choice for everyone.

4. Stripe

Stripe is an excellent service because it allows you to have as many virtual cards as you want. You can also get their physical cards if needed. This service is ideal for businesses that have to make frequent payments to their employees or clients. With Stripe, you don’t have to keep waiting as it allows instant virtual card creation.

It offers various services, including payment solutions, management automation, and financial services. They also have multiple and single-use virtual cards. It has a fast and easy setup, making it convenient to use.

5. Airtm

If you are looking for a virtual card platform with fewer restrictions, Airtm could be the best choice for you. It allows you to transfer money using the market’s exchange rate. Using Airtm, you can use your money to fund your virtual card.

One of the best things about Airtm is that you can use it to make online payments in any currency. Additionally, it offers cards that can be recharged with cryptocurrency. Unlike other services, it doesn’t require you to maintain minimum balances. You can add money from over 800 different banks by subscribing to this service.

6. Brex

Brex is a full-scale financial application that gives you access to corporate digital cards. So if you want a virtual card for your business, Brex could be the perfect choice. You can also use Brex to issue digital cards to your employees and team members.

It has many valuable features that make it more efficient for your business. It allows you to set limits to control spending and tracks your expenses. Best of all, you can earn rewards and points on all your card spending. Brex includes no annual fee or foreign transaction fees.

7. Venmo

The Venmo Credit Card can be helpful in various ways. It is integrated with the Venmo app that you love to use. Using the Venmo Credit Card, you can easily manage your account directly from the Venmo app. The card comes with a Venmo QR code, making the activation process quick and easy.

With the help of the Venmo Credit Card, you can make secure payments, earn cashbacks, split purchases with your Venmo friends, and request new virtual card numbers.

8. Skrill

Powered by PaySafe, Skrill allows you to pay bills, purchase crypto, and send and receive money anywhere. Not just that, but you can also use your Skrill virtual card to shop anywhere online. If you already have a Skrill account, it will be easier for you to get a prepaid digital card.

The digital prepaid MasterCard from Skrill is accepted globally. You can use this virtual card at any place where they accept MasterCard. It also supports different currencies and allows for hassle-free transactions. Skrill offers the first virtual card for free. Plus, it has no annual fee.

9. Revolut

If you want free and instant virtual cards, you should use Revolut. You can easily create digital debit cards using their app. They are now available in more than 50 states in the US. They offer various services, including virtual cards, budgeting, analytics, crypto, and more.

Revolut has options for both business and personal use. They offer four types of plans: Standard, Metal, Plus, and Premium. While the Standard plan is free, the other three are paid and have more features.

10. Advcash

Advcash is an online service provider with an array of services under its wing. From making local and international transfers to bank transfers, Advcash does it all. It also has support for digital currencies for interested clients.

With Advcash, you can shop online without any hassles. It enables you to make payments to your existing email address, visa card, and other users. Best of all, you can use it to draw money from any ATM. Even if you have a single account, you can add multiple currencies.

11. Open.money

Next up, we have Open.money, a reputable online service that allows individuals and organizations to track, control, and manage online spending in real-time. After you get your Open.money card, you can travel cashless. It helps you to spend money smartly.

This service is ideal for anyone who wants to make easy, cashless payments. Open.money is easy to use and lets you track your spending in real-time. Best of all, it helps you to automate your payments for smooth transactions. Get rewards for every payment you make.

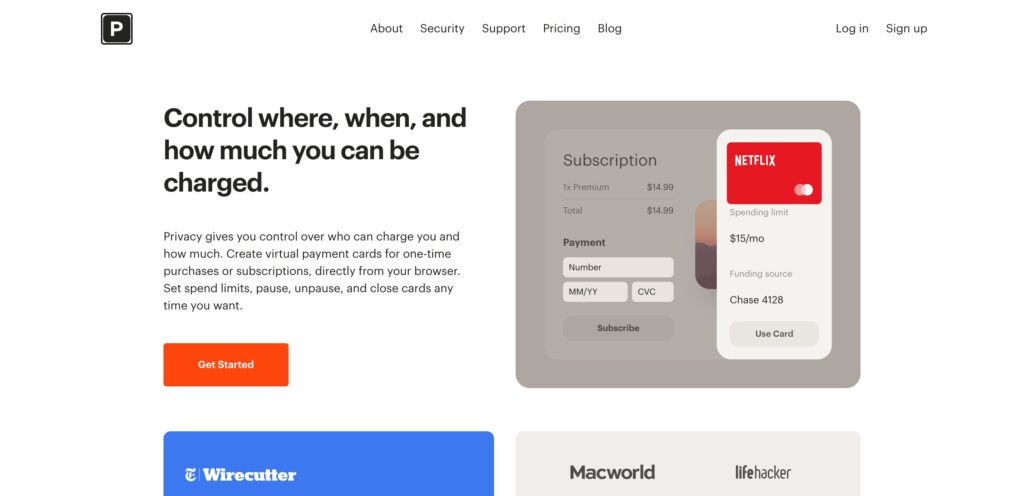

12. Privacy.com

With Privacy.com, you can protect your money while shopping online. It has great features that make it stand out from other services. Every virtual credit card comes with a unique card number that can be used only by the individual merchant. In case the card number gets exposed, your card will become unusable.

Privacy is one of the best virtual credit card services out there. It is highly secure and easy to use. It has features like browser extensions and instant email alerts for transactions. The card automatically closes after making the first transaction.

13. American Express

American Express is best suited for contract workers and freelancers. It provides a digital credit card service that is extremely easy to manage and use. Digital marketers, freelancers, and other self-employed professionals can use this card to make online purchases.

This card has many useful features like it allows you to track all your expenses, so you stay informed about where your money is going. You can also set limits to control your spending. Unlike other services, it is fast and easy to set up.

14. Citi

Just so you know, Citi is the third-largest banking organization in the US. It is a highly reputable service that offers the benefits of virtual cards. However, this service is not available for all Citi cards. To get a Citi digital card, you need Virtual Account Numbers from the bank.

Having the Citi virtual card makes local and international payments easy. It supports 30 different currencies and is available in 40+ countries. Citi virtual cards are mainly suitable for businesses. It allows you to limit the number of uses for your card. Apart from that, you can also set a maximum range for spending.

15. Capital One

If you are a Capital One credit card owner, you can easily apply for their free virtual credit card service. The good thing about Capital One virtual credit cards is that they can be integrated with your Capital One credit card account. For this, you will have to install the Eno browser extension.

Since the card is linked to your bank account, you can earn various rewards and benefits. It allows you to delete, block, or unlock your card numbers for any vendor.

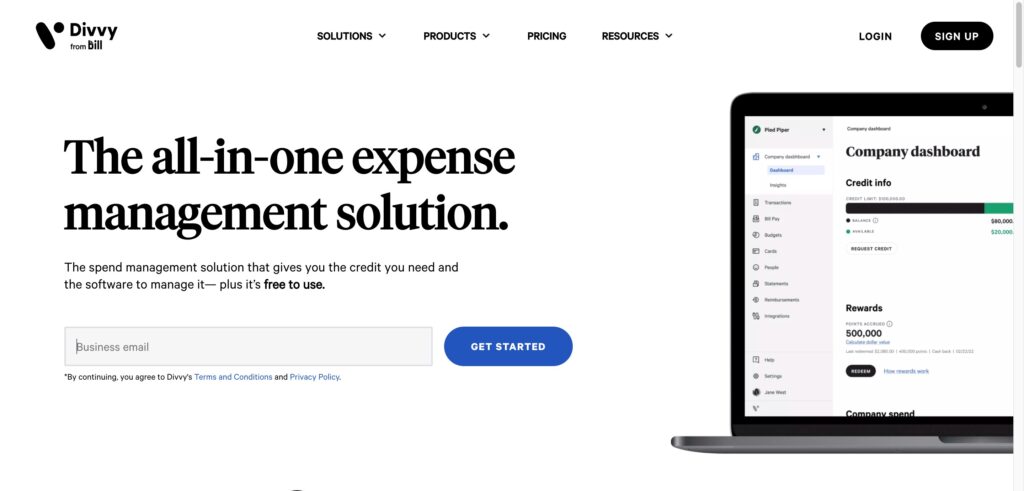

16. Divvy

If you are looking for a virtual card specifically for online payments, you should go for Divvy. It assigns a 16-digit card number which is used for making transactions. You can apply for multiple cards and set a limit on each card.

Divvy is popular because it offers protection against data breaches. You can also free or delete your virtual cards when needed. The advantage of owning a Divvy virtual card is that you can use it anywhere. You can choose the card amount and load funds from your budget.

17. Netspend

Next in the line is Netspend, which is best for creating custom prepaid cards. It works as an efficient online financial management solution. It provides users with a digital prepaid card that can be personalized using a symbol or photo of their choice.

With Netspend, you can easily create temporary card numbers and then use them on sites that don’t accept debit cards. You can use your Netspend card all across the country without any hassles. No matter what your location is, you can still check your balance. It sends text messages for transaction alerts.

18. Bento

With the help of Bento, you can easily manage your organization’s spending and expenses. You can use this service to generate a digital card for your account. Bento digital card is safe to use. It securely stores your card information in your account.

The best thing about Bento is that it allows you to manage both physical and digital cards. Compared to a physical card, it provides more security. It enables you to make easy transactions for your business. It offers two card options: spend-limit virtual debit cards and fixed-value virtual debit cards.

19. EzzoCard

If you want a virtual card for making anonymous online payments, you should consider applying for EzzoCard. With the help of this card, you can shop at any online store without disclosing your identity. EzzoCard offers both virtual credit and debit cards that are accepted globally. You can use these cards anywhere they accept MasterCard and Visa.

The good thing about EzzoCard is that they offer a variety of options to choose from. The available options are Black card, Green card, Blue card, and Brown card. Each card has different validity and features. The application process is easy and requires no bank account.

20. ePayService

For safe and secure online transactions, you can rely on ePayService. They provide digital cards for your everyday needs. It is one of the best virtual card services that allows you to manage online shopping with cards.

It helps you to customize your online shopping using cards of different values. You can choose a virtual card that suits your requirement the best. The best thing about ePayService is that they don’t charge any purchase transactions or monthly fees.

21. IronVest (Formerly Blur)

IronVest is a popular virtual card service that enables you to protect your bank transactions, payments, password, and privacy from cyber attackers. With IronVest, you can easily check out from your browser, tablet, or phone. For convenience, you can sync it across all your devices.

The unique thing about IronVest is that it can create a new card number for every transaction or purchase. It also can block hidden trackers, personal data collection, and more. It encrypts your password for maximum protection.

22. Emburse

Lastly, we have Emburse, a company that offers both physical and virtual cards. It prevents fraud and scams by verifying the person’s identity for each transaction. This makes it a safe virtual card service.

Every Emburse card helps streamline and simplify purchasing and payment. It has user-friendly features like role-based permissions and approval flows, auto-categorization of expenses, mobile reminders and receipt capture, and more.

You can shop online without worries by using a virtual debit card/credit card. You can also use these cards to make local and international transactions. Choose any of the mentioned services based on your requirements.

Also read: 16 Best Budgeting Apps for Android & iPhone

Frequently Asked Questions (FAQs)

What is a Virtual Credit Card (VCC)?

A virtual credit card or VCC is a digital credit card with no physical existence. It is an add-on issued on your primary credit card. All relevant details like the card number, CVV number, and expiry date are visible online.

How does a Virtual Credit Card work?

A virtual credit card works just like a plastic card. You can use it to make online purchases, make payments, etc. The only difference is that it is available online.

What is the Difference Between a Credit Card and a Virtual Credit Card?

Virtual credit cards exist entirely online. However, you can use them the same way as your physical credit card. It has a unique 16-digit card number, expiry date, and CVV number.

Is Virtual Card Debit or Credit?

A virtual card can be either a debit card or a credit card. The only thing is that you cannot hold it in your hands. It can be accessed only on an online platform.

Are Virtual Credit Cards Safe to Use?

Yes, virtual credit cards are safe to use. Unlike physical cards, you don’t have to swipe them. This makes it impossible for anyone to defraud you using the card. Plus, they have a limited validity period which further enhances the card’s security.

Why do People use Virtual Debit or Credit Cards?

Virtual debit or credit cards are very safe to use. If you don’t want to use your original card number, you can use a virtual card instead. These cards allow you to pre-set the payment amount and tie it to the invoices you are paying. Plus, the 16-digit card number is for single use only.

How to Get Money Off a Virtual Card?

You will have to transfer your virtual funds to your bank account to get money off a virtual card. If your virtual card provider allows bank transfers, you can do that by logging in to your online account.

Can You Use a Virtual Card at ATM?

Some virtual cards allow you to withdraw money from ATMs. This is done with the help of a mobile app.

Where can I use my Virtual Visa Card?

You can use your virtual Visa card anywhere they accept Visa, both online and offline.

Can I use a Virtual Visa Card at Gas Stations?

Yes, you can use your virtual Visa card at gas stations if they accept Visa.

Can I Transfer Money from my Virtual Card?

You can transfer your virtual funds to your bank just like. Your virtual card has a card number, expiry date, and CVV, just like a plastic card.